Advertisement

In the realm of credit cards, the Macquarie Black Credit Card shines as a beacon of rewards and convenience. Let’s find out why this sleek black card could be the perfect addition to your wallet.

The Macquarie Rewards program offers cardholders a range of benefits, from generous points-earning opportunities to convenient redemption options. By understanding how to take advantage of this program effectively, you can make the most of your spending and potentially enjoy significant savings on both your credit card and home loan. So if you’re looking for a c

Advertisement

Ongoing rewards on international purchases

With Macquarie Black or Platinum credit cards, you’ll continue to earn rewards points on committed international purchases. This means that every transaction you make, whether at a foreign boutique or an international online retailer, contributes to the accumulation of rewards. For traveling travelers or avid online shoppers, this feature translates into potential savings and rewards that add up over time.

Simplified Currency Conversion

Navigating currency conversion is essential for seamless international transactions. When using your Macquarie credit card in a currency other than the Australian dollar, understanding the conversion process becomes essential. Here’s what you need to know to make informed decisions and maximize your purchasing power abroad.

Advertisement

Choosing to pay in foreign currency allows you to complete the transaction without immediate currency conversion. Instead, Visa will convert the amount to Australian dollars using the exchange rate applicable on the date of the transaction. This method is simple for purchases made in widely used currencies such as US dollars, Canadian dollars or euros.

Choosing to pay in Australian dollars can trigger dynamic currency conversion, where the merchant converts the foreign currency into Australian dollars at the time of the transaction. While this option exempts you from international transaction fees, it is essential to note that merchants may impose additional fees for this service. To ensure good value for money, it is recommended to compare conversion rates between the merchant and your credit card company.

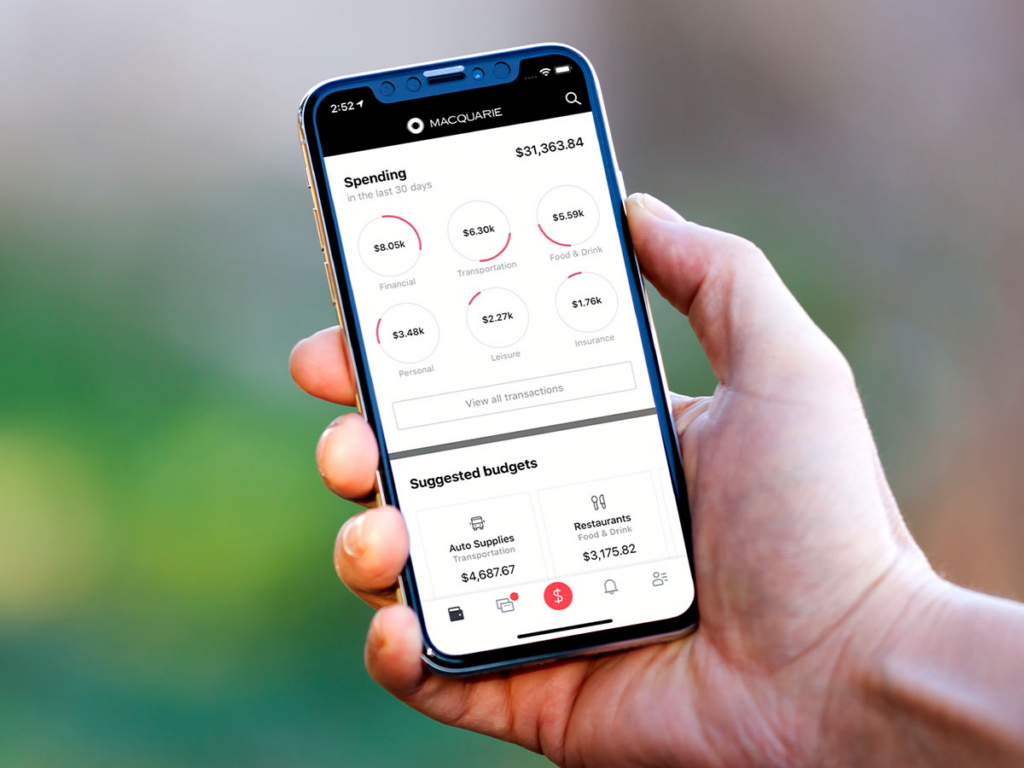

Easy access to statements

Your monthly credit card statements are available online at the end of each billing cycle. Whether you’re tracking your spending habits or reviewing transactions, accessing your statements is easy. Plus, receive statements online, reduces paper waste and helps you stay financially organized.

Unlocking Macquarie Black Card Rewards

In the world of credit cards, maximizing rewards is the name of the game, and the Macquarie Black Card leads the pack. This premium credit card isn’t just a piece of plastic; It’s a gateway to a world of benefits and rewards that can make every purchase more rewarding. Let’s dive deeper into how you can harness the power of the Macquarie Black Card and unlock its full potential:

Earn 2 points for every dollar spent: With the Macquarie Black Card, earning rewards is as simple as swiping your card. For every dollar spent on purchases, you earn 2 Macquarie Rewards points.

Redeemable eGift Cards: The Macquarie Rewards program offers a wide range of redemption options, but one of the most popular choices is eGift cards. With over 50 leading retailers available on Macquarie Marketplace, you can redeem your points for eGift cards at stores like Myer, Woolworths and Amazon.

Optimize the clearing account: Take your rewards strategy to the next level by leveraging your offset account for your home loan. By linking your Macquarie Black Card to your offset account, you can effectively reduce the interest you pay on your home loan while earning rewards for your credit card spending.

Variable interest rates: Stay informed about the variable interest rates associated with the Macquarie Black Card. Currently set at 20.70% per year for purchases and cash advances, it is essential to manage your card responsibly to avoid unnecessary interest charges.

Rewarding loyalty

Generous Macquarie Rewards: With the Macquarie Black Card, earn an impressive 2 Macquarie Rewards points for every $1 spent. These points can be redeemed for a range of rewards, including eGift cards from over 50 popular Australian retailers.

Monthly Spending Bonus: Spend $5,000 per month on your Macquarie Black Card and earn up to $54 in gift cards. It’s a little extra incentive to indulge in your favorite purchases.

International Convenience:

No international transaction fees: Say goodbye to pesky international transaction fees. Whether you’re traveling the world or shopping online at overseas retailers, enjoy the convenience of shopping without incurring additional costs.

Visa exchange rates: Benefit from competitive exchange rates from Visa without any additional fees or charges. Your international transactions are processed seamlessly, ensuring you get the best value for your money.

Additional advantages

Interest-free periods: Enjoy up to 55 interest-free days on purchases, giving you enough time to manage your expenses without worrying about interest accruing.

Free additional cardholders: Request up to 4 additional cardholders at no extra cost. Extend the benefits of your Macquarie Black Card to your loved ones and optimize your family’s spending.

Security and tranquility

Travel and shopping protection: Travel with confidence knowing that you and your family are covered by Foreign Travel Insurance. Plus, benefit from purchase protection and Buyer’s Advantage coverage on purchased purchases.

Convenient Payment Options: Seamlessly integrate your Macquarie Black Card with Apple Pay and Google Pay for added convenience. Additionally, if you lose your card, continue making payments using your mobile device while you wait for a replacement.

Why apply for the Macquarie Black Credit Card

Applying for a credit card, especially one as prestigious as the Macquarie Black Card, requires careful consideration and preparation. By understanding the eligibility criteria and diligently following the application process, you can increase your chances of approval and gain access to the exclusive benefits and rewards offered by the Macquarie Black Card. So, if you meet the criteria and are ready to enjoy the premium perks and privileges, don’t hesitate to apply for the Macquarie Black Card today.

Required documentation

When applying for the Macquarie Black Card, please ensure you have the following documentation on hand:

Annual Gross Salary: Provide documentation to verify your annual gross income, demonstrating your financial stability and creditworthiness.

Monthly Expenses: Detail your monthly expenses to help assess your financial obligations and determine your ability to manage credit responsibly.

Current employer details: Include the address and telephone number of your current employer to verify your employment status and stability.

Accountant details: If you are self-employed or retired, please provide your accountant’s contact information to verify your income and financial situation.

Australian driver’s license number: If applicable, please provide your Australian driver’s license number to confirm your identity and eligibility for the Macquarie Black Card.

Enjoy premium benefits

As a Macquarie Black cardholder, you’ll unlock a range of exclusive benefits, including:

Generous Rewards Program: Earn rewards points on qualifying purchases, redeemable for travel, merchandise or cashback.

Free travel insurance: Enjoy peace of mind with free travel insurance coverage for you and your family when you book a trip using your Macquarie Black Card.

Dedicated Concierge Service: Access personalized assistance for travel booking, event planning and more through our dedicated concierge service, available exclusively to Macquarie Black cardholders.

Application process

Ready to experience the benefits of the Macquarie Black Card? Follow these steps to sign up:

Confirm Eligibility: Make sure you meet the eligibility criteria by bundling your credit card with a home loan and qualifying as a private bank or commercial bank customer.

Gather documentation: Gather the necessary documentation, including proof of income, employment details and identification documents.

Submit Application: Apply for the Macquarie Black Card online or visit a Macquarie Bank branch to complete the application process.

Managing your expired or expiring credit card

Your credit card is a vital tool for managing your finances and making purchases comfortably. However, as with any piece of plastic, it has an expiration date.

Automatic Card Renewal: In most cases, credit card issuers automatically send you a new card if your existing card is about to expire. This ensures you have a smooth transition and continue to enjoy your credit card benefits without interruption.

Situations where automatic updating cannot occur: There are cases where your credit card issuer cannot automatically send you a new card. This can happen for a variety of reasons related to your account or how you use your card.

Contacting your card issuer: If you find yourself in a situation where your card has expired and you haven’t received a replacement, don’t panic. Simply call the customer service number provided by your card issuer. They are available 24/7 to help you.

Activating your new card: Once you receive your new credit card, it’s crucial to activate it immediately. Most issuers provide simple activation instructions online or through a dedicated phone line. By activating your new card, you ensure that it will be ready to use whenever you need it.

Updating payment information: Once you’ve activated your new card, remember to update any automatic payments or recurring subscriptions with your new card details. This helps prevent interruptions to your services and ensures your payments continue to process smoothly.

Transition to digital wallets: If your previous card was set up in your digital wallet (like Apple Pay or Google Pay), the good news is that your new card will automatically be added to your digital wallet. This means you can start using it right away for online and in-store purchases, without waiting for your physical card to arrive in the mail. If you haven’t yet set up your digital wallet, now is the perfect time to do so for greater convenience and security.

Conclusion

With its low annual fee, lucrative rewards program and international benefits, the Macquarie Black Credit Card is more than just a piece of plastic – it’s a gateway to a world of perks and benefits. Whether you’re a frequent traveler, a savvy shopper, or simply want to maximize your spending, this card has something for everyone. Take advantage of the opportunities and request your Macquarie Black Card today.

Did you like this article?

While I have no personal interests, I can certainly help by providing information about the different types of credit cards and how to effectively use comparison tools to find the best option based on your specific needs.