Advertisement

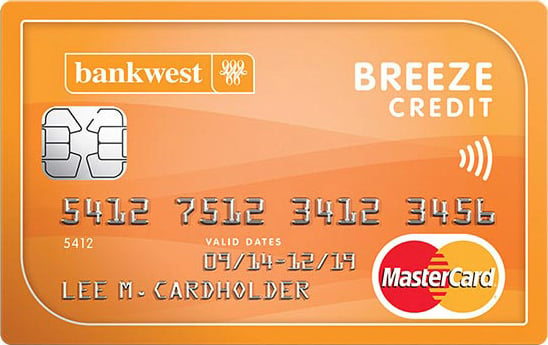

The Bankwest Breeze Classic credit card is a great choice for those looking for a convenient way to manage their finances. With 0% interest on purchases, cashback rewards, and no annual fees, the Bankwest Breeze Classic credit card offers unbeatable value.

This card credit card has low fees and no annual fee, but it also offers a competitive introductory offer. The Breeze Classic credit card is a great option for people who are looking for a low-cost credit card with no annual fee. It also has 0% interest on purchases and balance transfers for the first 12 months.

Advertisement

Bankwest Breeze Classic features

The Bankwest Breeze Classic Mastercard gives new customers a chance to save on interest for 15 months with 0% p.a. on purchases and balance transfers. The Bankwest Breeze Classic Mastercard is a simple, low rate credit card that currently gives new customers a few ways to save money. The card has no annual fee.

It is simple enough to use and will be accepted by most merchants. This is an offer for a credit card that has a $49 annual fee, but the first year is waived. This card offers great benefits and is perfect for people who need to carry a balance because of their spending habits.

Advertisement

Mastercard type card

The BankWest Breeze offers you a few ways to save on your credit card costs. There’s no interest for the first 15 months and there’s no annual fee in the fist year. On average, the balance transfer may be more affordable with this card.

You can’t actually spend money on the card until you settle your balance, but there are a few banks that allow you to borrow from the credit line. If you pay off your debt early, Bankwest will even offer interest-free days on purchases.

Main Advantages

Bankwest is a well-regarded Australian bank that offers competitive interest rates and an easy to use app. It’s popular with a number of people for its high balance transfer limit, which is one of the highest in the market at 95% of available limit.

Credit card use has changed significantly in the past few years. Consumers are looking for a way to save money while having fun with their purchases. Most credit cards do not have a minimum limit and it’s usually hard to tell if you can get a better deal on it. The lowest possible credit card limit is $1,000.

Bankwest Breeze Classic

Mastercard is one of the largest credit cards in the world. They offer many different credit card options for consumers to choose from, including a Mastercard flag type credit card. This new category of Mastercard card is designed for people who want a card that can be used internationally. The Bankwest Breeze Classic provide such benefit.

Why apply for Bankwest Breeze Classic credit card

The Bankwest Breeze Classic Mastercard is a great credit card that lets you earn interest free on purchases, in addition to a few other benefits. To apply for the card, simply visit the website and complete an online application.

Carefully review the requirements for this offer before you apply. Many applicants miss out on their chance because they don’t take their time to read the information provided, and/or don’t have everything they need to complete their application in one sitting.

How to request your Bankwest Breeze Classic credit card

Online application for a bank card is quick and easy. Just be sure to meet eligibility requirements and have all your necessary documentation on hand to shorten the application process. It takes about 15 minutes to complete the application.

Residency criteria apllication is limited to permanent Australian residents or citizens. We’ve introduced a new card that offers great deals exclusively to new customers. These cards only have the introductory rates available and they can only be used by new customers or those that haven’t purchased this card before.

Balances cannot be transferred from existing Bankwest-branded credit cards. However, you can transfer up to 95% of your balance with this balance transfer offer. Futhermore, you must be at least 18 to apply for this credit card.

Bankwest Requirements for application

Your personal information. This includes your full name, date of birth, residential address, email address, and contact number. Ideally, you’ll be asked to provide proof of your identity, such as a passport, Medicare card or driver’s licence.

Employment details and contact information. This includes your current position, the length of your employment, and the name of your employer. Personal or business financial information. This includes details of your income, expenses and any existing debts or assets.

Did you like this article?

You need a credit card that has the best features for you. Start by identifying what interests you most and then apply for your card. Don’t forget to check out our news portal with useful articles about credit cards, which will also help answer your questions.