Advertisement

These works are highly recommended for those who wish to improve their knowledge of the financial market and achieve better results in their investments. There are several reasons why investors can benefit from reading these books. They may wish to gain knowledge about innovative investment strategies or simply deepen their understanding of their own investments.

Investors are always looking for ways to improve their finances. This is especially true when stock markets fluctuate and investors need help understanding what they must do to remain profitable. The books on this list are great resources for investors who want to be prepared for the next market change.

Advertisement

No matter what your investment goals are, these books can be useful to you. They range from basic information about investments to more detailed research, which can help you make informed decisions in the market.

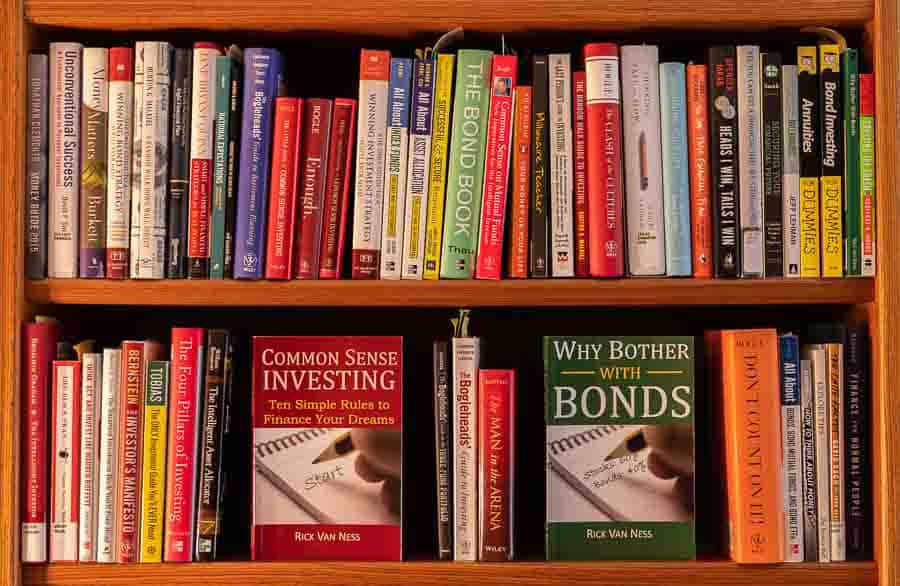

Have investment books in your library

Investing is an essential skill to learn. It’s not simply about allocating your money to some actions and hoping for the best result. It is necessary to understand the market, have knowledge about how to invest and know which assets you are investing your resources in.

Advertisement

Given the volatility of share prices, it is extremely important that you take into account the decisions you make. A recommended approach to learning about investing is to start gradually and build your knowledge by reading financial blogs.

Regardless of your level of experience as an investor, it is essential to gain knowledge about the different types of investments available. There are a wide variety of books that teach these skills and more. However, it can be difficult to know where to start and which books are truly valuable.

Your investing style

Different investment styles have different needs. To effectively assimilate information about your own style, it is recommended to choose the best investment books that are aligned with it.

By way of example, an investor who follows the value investing strategy may look for books that address this specific topic, while an investor guided by the growth investing strategy may look for books focused on this specific approach, and so on.

An investor who acquires and holds financial assets may find useful information in books about investing in individual stocks and bonds. On the other hand, an aggressive investor would benefit more from reading books on options and futures trading.

This introduction will provide a brief overview of the distinction between long-term investors and aggressive investors. Furthermore, some types of books will be suggested that can be useful for both investor profiles.

So, you have finally made the decision to start your investments? Great! However, before you start, it is essential to understand your investment style.

A variety of investment books available

- The book “The Intelligent Investor”, written by Benjamin Graham, is a fundamental work for those who wish to enter the world of investments in an intelligent and cautious way.

- A Random Walk on Wall Street, written by Burton G. Malkiel.

- The Essays of Warren Buffett is a compilation of writings by renowned investor Warren Buffett.

- The work “The intelligent investor” is essential reading for those who wish to acquire solid knowledge about the financial market. Written by renowned investor Benjamin Graham.

- Book “Security Analysis”: an essential guide to understanding and applying protection measures in various areas.

- The title of the book is “Thinking, Fast and Slow”.

- The book “How to Win Friends and Influence People” is a highly recommended read for those who want to improve their interpersonal skills.

Key investing lessons from each book

Below, I present the main investment lessons extracted from each book:

The book “The Millionaire Next Door”, written by Thomas Stanley and William Danko, addresses the idea that those who become millionaires are not necessarily those with high incomes, but rather those who manage to spend less than they earn.

“Rich Dad, Poor Dad”, written by Robert Kiyosaki, is a book that aims to teach strategies for building wealth. Through the story of two fathers with different approaches to life, love and money, important lessons about financial education are transmitted.

Did you like this article?

f you liked this content, I would be very grateful if you could share it on your social networks. This will allow your family and friends to have access to the information contained here and to benefit from the valuable advice offered. We thank you in advance for your kindness.