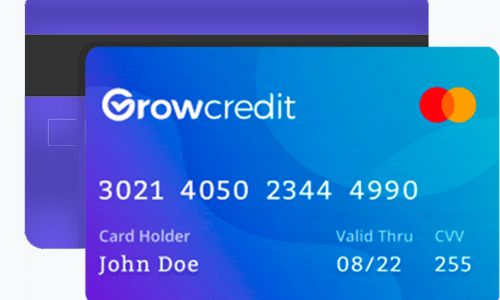

In today’s digital financial landscape, innovation is key to standing out. The Grow Credit Mastercard presents a modern and effective solution tailored to meet the needs of a growing audience seeking to improve their credit without the pitfalls of traditional credit products. As the demand for digital payments and financial services that offer more than just transaction capabilities increases, the Grow Credit Mastercard distinguishes itself with unique benefits and cutting-edge technology.

This article explores what makes the Grow Credit Mastercard such an attractive option. We will examine its key advantages, consider some potential drawbacks, and discuss how and when this card might best serve your needs. Our analysis will help you determine if this card is the right choice for your financial goals.

Benefits of the Grow Credit Mastercard:

The Grow Credit Mastercard offers a range of benefits that provide a competitive edge over other credit-building options. Primarily designed to help users build credit, it allows payments for subscriptions like Netflix, Spotify, and many others to contribute positively to your credit score by reporting these payments to the major credit bureaus.

A significant benefit of the Grow Credit Mastercard is its tiered membership plans, ranging from a free plan with a $17 monthly limit to a premium plan with a $150 limit. Each plan caters to different levels of spending and credit-building needs, providing flexibility based on the user’s financial situation.

Another standout feature is the absence of traditional fees and interest charges. There is no hard credit check, which makes it an ideal option for individuals with no credit or poor credit histories who are looking to establish or improve their credit scores.

Drawbacks

While the Grow Credit Mastercard has many benefits, it does come with some limitations. One of the main drawbacks is its low spending limits, which are tied directly to the tier of membership you choose. This might restrict its usefulness for individuals who have higher monthly subscription costs.

Additionally, the card cannot be used for general purchases or to carry a balance, which limits its utility compared to traditional credit cards. This focus solely on subscription payments means it’s not suitable for those seeking a card for everyday spending.

When the Grow Credit Mastercard is Worth It

The Grow Credit Mastercard is particularly valuable for those who want to build or improve their credit without the risk of accumulating debt. If you have multiple subscriptions, such as streaming services or mobile phone payments, linking them to this card can help you establish a positive payment history.

To maximize the benefits, choose a membership plan that aligns with your budget and credit-building goals. Make sure to maintain sufficient funds in your linked bank account to cover these payments, ensuring they are reported to the credit bureaus without any issues.

Requirements and How to Apply for the Grow Credit Mastercard

To qualify for the Grow Credit Mastercard, you need to meet a few basic requirements. You must be at least 18 years old, have a valid Social Security Number, and be a permanent resident of the United States.

Additionally, you need to have a bank account in your name, where your income is deposited, as this is how the card will automatically pay off your subscription charges each month. A valid email address and phone number are also required to complete the application process.

Applying for the is straightforward. Simply visit the Grow Credit website, where you can begin the application process by entering your personal information, such as your name, email, and phone number. You will then be prompted to link your bank account using a secure service.

Since the Grow Credit Mastercard does not require a hard credit check, you won’t need to worry about any impact on your credit score during the application process. Once your application is reviewed and approved, you can start using your virtual card for eligible subscriptions to build your credit.

Alternatives to the Grow Credit Mastercard:

While the card is an excellent tool for credit building, other options might better suit your needs. For example, the Chime Credit Builder Secured Visa Credit Card offers a secured line of credit with no fees and a higher spending limit, which may be more appealing for those seeking broader usage.

Conclusion and Experiences:

The card offers a unique and effective way to build credit through everyday subscription payments. Its no-fee structure, coupled with the absence of interest charges, makes it an appealing choice for individuals looking to improve their credit without financial strain. However, potential users should consider its limitations, such as low spending limits and restricted usage to subscriptions, before deciding if it is the best fit for their financial needs.

Overall, if you align with the profile of a user who can fully utilize the advantages offered by Grow Credit, this Mastercard can be a powerful tool in your credit-building arsenal. However, exploring other credit-building options may be wise for those with different financial priorities or spending habits.

You will be redirected

<h1>The ANZ Rewards Black Credit Card</h1> <h2 style=' font-weight: normal; line-height: 1.2rem !important; font-size: 17px !important;'>Unlock exclusive benefits with the ANZ Rewards Black Credit Card</h2>

<h1>The ANZ Rewards Black Credit Card</h1> <h2 style=' font-weight: normal; line-height: 1.2rem !important; font-size: 17px !important;'>Unlock exclusive benefits with the ANZ Rewards Black Credit Card</h2>  <h1>The ANZ Rewards Black Credit Card</h1> <h2 style=' font-weight: normal; line-height: 1.2rem !important; font-size: 17px !important;'>Sign up today and unlock a world of rewards with ANZ</h2>

<h1>The ANZ Rewards Black Credit Card</h1> <h2 style=' font-weight: normal; line-height: 1.2rem !important; font-size: 17px !important;'>Sign up today and unlock a world of rewards with ANZ</h2>  <h1>The Macquarie Black Credit Card</h1> <h2 style=' font-weight: normal; line-height: 1.2rem !important; font-size: 17px !important;'>Some key features and benefits often associated with this card</h2>

<h1>The Macquarie Black Credit Card</h1> <h2 style=' font-weight: normal; line-height: 1.2rem !important; font-size: 17px !important;'>Some key features and benefits often associated with this card</h2>  <h1>The Visa Platinum credit card</h1> <h2 style=' font-weight: normal; line-height: 1.2rem !important; font-size: 17px !important;'>Elevate your financial journey with the Visa Platinum credit card</h2>

<h1>The Visa Platinum credit card</h1> <h2 style=' font-weight: normal; line-height: 1.2rem !important; font-size: 17px !important;'>Elevate your financial journey with the Visa Platinum credit card</h2>